Ashraful Aid celebrates its recent collaboration with Regent Business School in Johannesburg. The

school invited Ashraful Aid to present the success of the Ubuntu Ukhuwwah micro-finance project.

Upon application, micro finances are provided to aspiring small businesses without charging the

business any interest. The intention is to provide developmental finance in a sustainable manner.

The project has been run in Pakistan for 25 years with much success and the Ubuntu Ukhuwah

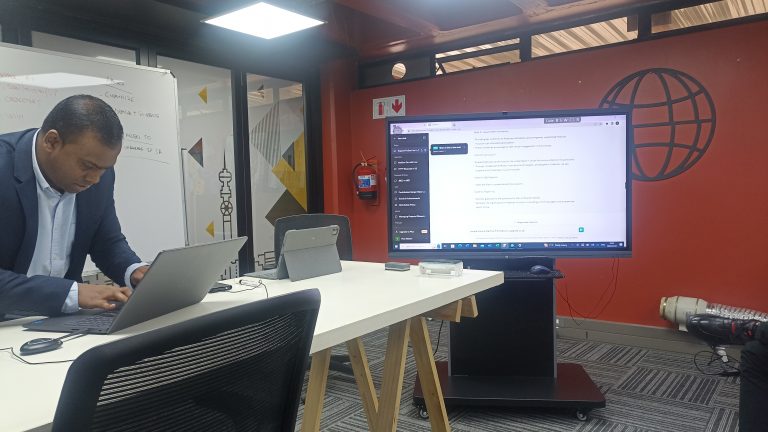

model therefore follows the same rollout formula. Notably, Regent Business School invited Ashraful

Aid to provide a presentation on “banking the unbankable” to their Master of Business

Administration (MBA) group this month. The fund is gaining both practical and academic accolades

in its success. Businesses can apply for micro-finance via the Ashraful Aid website by submitting key

information about operations, services and products. To be considered, it is important to explain

how the business will use the funds to expand. The fund is open to all small businesses seeking

growth opportunities.

Unbankable clients is a key area which is untapped in the South African economic context. People

who are unbanked or underbanked tend to use alternative forms of financial services, such as check-

cashing outlets, payday lenders, and money orders to handle their monetary needs. An unbanked

customer is a person who does not have a savings or checking account with a bank or credit union.

People who are unbanked don’t have access to savings or checking accounts and don’t use other

traditional banking services, such as loans or credit cards. In addition to people who are unbanked,

some are “underbanked.” Underbanked individuals or households might have access to a checking

or savings account through a traditional financial institution.

“Innovative ideas to bank the unbankable explored by the students were most thrilling. The effective use of AI technology in problem solving was fascinating.

It was a great opportunity for Ashraful Aid to network with these students who have a wealth of knowledge and expertise between them ,which could be very useful to successful candidates of the Ubuntu funds” said Sabera Asmal, the Project Head of Ubuntu Ukhuwah.

The collaboration with Regent Business School therefore challenged MBA students to assess how to

attract the unbankable into the bankable echelon. The inclusion of Ashraful Aid in the academic

conversation marks a major step in the recognition of the Ubuntu Ukhuwah fund and the strides

being made in the rollout of micro finance to the unbankable sector.

Humanitarian aid is important because it provides life-saving assistance to people affected by conflicts, disasters and poverty.

Humanitarian aid is vital in reducing the impact of crises on communities, helping recovery and

improving preparedness for future emergencies. We appeal to the public to join us in the availing of

resources for the Ubuntu Ukhuwah project and assist small businesses in growing the South

African economy.